Personal Finance / Getting out of Debt

Did you know 70% of nurses graduate with debt? It’s very common, so if you’re struggling with debt, know that you’re not alone.

Debt can be helpful in allowing us to do things that have a big upfront cost, like buying a car or home. For nurses, debt can make it possible to pay for school. But taking on debt can be a slippery slope, especially when lenders offer low introductory rates that give way to fees down the line. The goal of managing debt is to find a balanced approach where we can leverage debt to open doors without getting carried away.

However, debt can easily become overwhelming. In this post, we’ll go over the steps you can take to get out of debt faster and improve your credit.

Get job matches in your area + answers to all your nursing career questions

3 things to know about debt

#1 Not all debt is equal

There are two types of loans, secured and unsecured. Secured loans include things like home loans, auto loans, or any loans that can be secured with collateral. Collateral are items the lender can claim if you fail to make good on your loan. Because these loans are less risky in the eyes of the lender, they’re generally cheaper to open.

Unsecured loans are more prevalent in the marketplace. They include personal loans, credit cards, and payday loans. These types of loans are based solely on your credit history. Because these loans are considered riskier in the eyes of creditors, they’re more expensive. However, they are typically easier to access.

#2 Your credit score influences the rates you’ll get

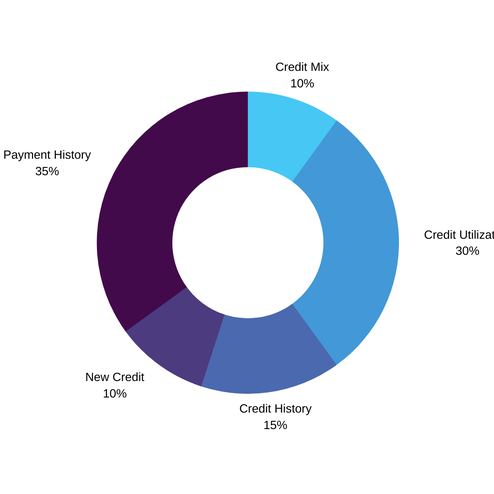

Your credit score is more or less a summary statistic about how well you have handled your credit in the past, or how “thick” your credit report history is. As you progress through your working life and pay back credit, your credit score rises. Your score is not the same as your report but reflects the information inside the report. The most common score used is called a FICO score. It’s based on these factors:

Payment History (35%) – Are you paying back at least your minimum balance every month? If defaulting, or not paying becomes a consistent pattern, your credit score will fall.

Credit Utilization (30%) – How much of your credit are you using? Lenders want to see this on the low side. So if you can borrow $30,000 but you’ve only borrowed $2,000, this will raise your score. Spending up to your limit each month will lower your score.

Credit History (15%) – How have you handled credit in the past? Past records of defaults can raise your rates.

New Credit (10%) – Are you opening a new line? You get rewarded for opening a new line of credit with a small bump in your credit score. However, the bump is minimal and you should avoid opening new lines of credit just for this purpose.

Credit Mix (10%) – Can you handle multiple types of credit? Managing a variety of lines of credit, like a student loan and a credit card, can raise your score.

#3 Know where lenders make money and that will save you money

Paying attention to where lenders make money can help you avoid fees and find the best rate for you. Interest rates are the most standard way lenders make money. It’s a good idea to shop around for the best rates. But be careful. Some lenders offer low rates only to have hidden fees elsewhere. Look out for balloon rates, where your rate can increase based on certain conditions like making a late payment.

Annual fees are another common way lenders make money. Rewards cards, for example, often carry high annual fees that can outweigh the actual rewards. Creditors also make money by charging interest on your balance. Most experts suggest paying your entire balance whenever possible rather than carrying over credit card debt.

Paying off credit card debt

Stop adding to your credit card debt

The first step to paying off debt is setting boundaries. This means removing by unlinking your online cards, switching to a debit card, or not carrying your credit card in your wallet. Not adding on debt will be paramount

Use a payoff strategy

We all have a different approach to money, so choosing a payoff strategy that works for you is a great way to pay off debt. The two strategies are Avalanche, where you start with the highest rate and chip away at that, or Snowball, where you start with the smallest debt and work your way up. While some may appreciate knocking out their nursing student debt in full before moving on, others may get more satisfaction from a series of smaller wins along the way.

Make multiple payments each month

You’re not limited to making a single payment per month. Every time you get a little extra use it for your balance.

Consolidate your debt

Consolidating your debt can make it easier to keep track of payments on multiple accounts. Consider getting a personal installment loan or transferring your balance to one card. With debt consolidation for nurses, you’ll have fewer interest rates to pay, saving you money. But make sure you read the fine print to avoid any hidden fees.

Call your company and ask about reducing your rate

It can feel like your credit card company is working against you or just doesn’t care about your concerns. But most credit card companies actually want to work with you, especially the larger, more reputable ones. Try calling to ask for a lower rate.

Building and maintaining your credit

Make on-time payments

Not only is being on time a great professional skill, but it will show lenders you can handle your debt. Making your payments on time will also help you avoid late payment fees.

Pay your balance in full

Rather than carrying a balance, whenever possible make complete monthly payments on a loan or credit card. This will show lenders you are only spending what you can afford. Your credit score goes up when you pay your balance in full.

Don’t utilize all your credit

Utilization is your balance compared to your credit limit, or how much you’re allowed to spend versus how much you’re actually spending. Low utilization can raise your credit score, so it’s important to keep an eye on your borrowing. The rule of thumb is to keep your credit card utilization below 30%. So, if you have $10,000 available, try not to borrow more than $3,000.

Keep old accounts active

If you have an old account open that doesn’t cost you any money, keeping it open rather than closing could be a positive mark on your credit score. Even if you no longer use the card, it shows a longer history of your credit and would be counted towards your utilization. Closing an account will also sometimes cause a small dip in your credit score.

Open new accounts

Showing that you’re continuing to open new lines of credit is a good sign for credit bureaus, but be careful not to open too many accounts at once, as multiple hard inquiries can lower your credit score. If you’re thinking about opening a new checking account, take the time to compare banks to find the best fit for your needs. What is required when opening a checking account usually includes a valid ID, proof of address, and an initial deposit, depending on the bank’s policies.

Now that you understand more about debt, you can start making a plan to pay off your debt and build better credit. Still have questions?

Get job matches in your area + answers to all your nursing career questions