Personal Finance / Savings Tips for Nurses

There’s no time like the present to get the most out of your savings, but it can be hard to know where to start. Cash savings, retirement, investments – what’s the most important thing to know? There are often unknowns that can make it feel hard to plan ahead, from how the market may change to how your cash flow may fluctuate. But financial health starts with taking accountability for what you can control right now. Financial adviser Elizabeth Husserl offers three tips for nurses to make it easier to save, and to make sure that you’re saving smart.

#1 Know Yourself First

The first step to building a successful savings plan is understanding your own goals and your own unique approach to wealth. Elizabeth recommends you start by reflecting on your short-term, mid-term, and long-term goals. Get out a pen and paper and take some time to answer these questions:

- What adds to your sense of wealth?

- What was your most recent experience of jealousy, and what did it teach you about what you long for?

- What would your 90-year-old self tell you was the most important thing you did in your life?

- If you had five years left to live, what would you most regret not doing?

- Imagine you are financially secure and that you have enough money to take care of your needs, now and in the future. How would you live your life? Would you change anything?

#2 Know Your Cash Flow

Before you can build a plan for saving money, you need to understand how your money is moving in and out. Look at your earnings and your spending. Do you notice any patterns? Are there items in your cash flow that could be removed or reduced to help you better utilize your income? Determine which of your expenses are non-negotiable, and what nonessential purchases may be causing leaks. Removing nonessential expenses is the most powerful move you can make to increase your savings. Elizabeth recommends taking your savings out first before paying for the discretionary items.

Questions to ask yourself:

- Do you really know where your money goes?

- What was the last item you regretted purchasing?

- Is your money being spent on the things that truly matter to you?

#3 Know the Best Vehicle for Your Goals

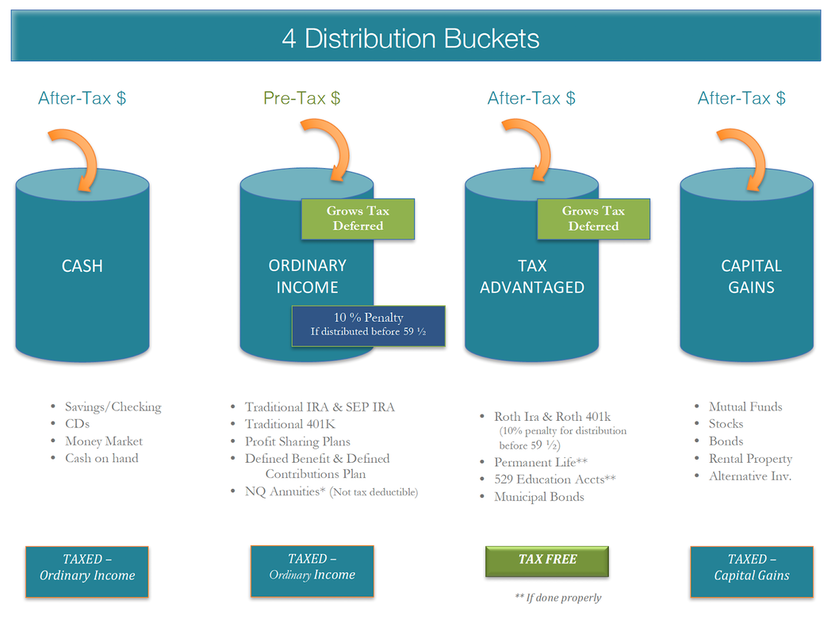

Some types of savings accounts and strategies are better suited for short-term goals like travel, while others make more sense for long-term goals like retirement or saving for college. There are four different distribution buckets where you can “park” your money to support your savings goals. The main differences between these options are how money goes in, how it grows, and how it’s taxed. Understanding each of

these distribution buckets can help you create an effective savings plan tailored to your specific goals.

Cash – This includes the money from your paycheck after taxes are taken out, your checking and savings accounts, and cash on hand. This money is taxed before it enters your account. The advantage to this savings bucket is liquidity, meaning you can access your money as soon as you need it. The downside is money in this bucket grows very slowly, with interest rates at 0.01% on average. One way to increase this growth is to open an account with an online bank, where interest rates are closer to 1.7% on average.

Ordinary Income – This bucket describes accounts where you receive a deduction once. Unlike cash, there is a penalty for removing this money early. Elizabeth encourages nurses to learn about and take advantage of employer matching plans, where they match your contributions to your account.

Tax Advantage – For these accounts, you pay your taxes when you put the money in, rather than when you take it out. All withdrawals are tax-free, making this an excellent vehicle for retirement and education savings.

Capital Gains – This bucket is best suited for mid-term goals. Your money grows more quickly in these accounts, because the yield is higher than a checking or savings account. Capital gains include stocks, rental properties, and mutual funds.

Now that you know what your savings goals are, what your cash flow is, and what the best vehicle is for your specific goals, you’re ready to save more and stress less! But if you still have questions, you can watch the full webinar for more details and a Q&A with Elizabeth Husserl.